What is the 3 investment strategy?

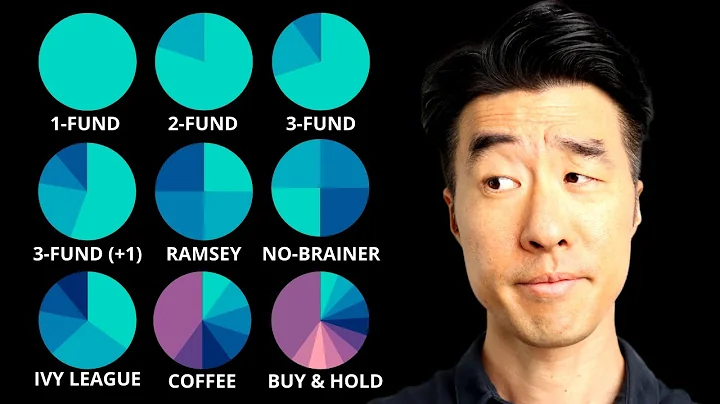

The three-fund portfolio consists of a total stock market index fund, a total international stock index fund, and a total bond market fund. Asset allocation between those three funds is up to the investor based on their age and risk tolerance.

A 3 fund portfolio is a diversified investment plan comprising three different kinds of assets, i.e., domestic stocks, domestic bonds, and international stocks.

The analysis process often depends on the investing style you're employing. We'll briefly look at three different styles of investing: value, growth, and income.

A three-fund portfolio is a portfolio which uses only basic asset classes — usually a domestic stock "total market" index fund, an international stock "total market" index fund and a bond "total market" index fund.

There are many types of investments to choose from. Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds.

What Are Level 3 Assets? Level 3 assets are financial assets and liabilities considered to be the most illiquid and hardest to value. They are not traded frequently, so it is difficult to give them a reliable and accurate market price.

Buy and hold

A buy-and-hold strategy is a classic that's proven itself over and over. With this strategy you do exactly what the name suggests: you buy an investment and then hold it indefinitely. Ideally, you'll never sell the investment, but you should look to own it for at least three to five years.

There's much debate about the relative merits of active and passive — two common investing styles — which are based on very different views of how capital markets operate. You can find out more about active and passive investing in Beyond the benchmark: active or passive investment management?

Key Takeaways. An investment strategy is a plan designed to help individual investors achieve their financial and investment goals. Your investment strategy depends on your personal circ*mstances, including your age, capital, risk tolerance, and goals.

Growth investing is the strategy where the prime focus is to increase the investor's capital. In this strategy, the money is placed on stocks of small and new companies whose earnings are expected to grow at a certain level.

What are the big three passive funds?

A robust literature describes the incentives and stewardship practices of the “Big Three” asset managers (BlackRock, Vanguard, and State Street Global Advisors), often referring to these asset managers as “passive.” This is so common that the “Big Three,” “index fund,” and “passive manager” are used almost ...

The three-fund portfolio is lazy investing at its best. It's simple, it's proven to have a better long-term track record of gains than picking single stocks and trying to time the market, and it lets you generally "set it and forget it" when it comes to saving for retirement.

Appreciation in the fund's NAV, which happens if the fund's investments increase in price while you own the fund. Income earned from dividends on stocks or interest on bonds. Capital gains or profits incurred when the fund sells investments that have increased in price.

Treasury bills, bonds and notes

Treasury bills, also known as T-bills, are widely considered to be the safest investment strategy for new investors. T-bills are basically small loans to the government, which the government then keeps for you, uses, and then pays you back, plus a little something on the side.

- High-yield savings accounts.

- Money market funds.

- Short-term certificates of deposit.

- Series I savings bonds.

- Treasury bills, notes, bonds and TIPS.

- Corporate bonds.

- Dividend-paying stocks.

- Preferred stocks.

With any diversified portfolio, keeping inflation-hedged asset classes on your watch list, and then striking when you see inflation can help your portfolio thrive when inflation hits. Common anti-inflation assets include gold, commodities, various real estate investments, and TIPS.

What are stage 3 assets in NBFC? Feb 20, 03:02. Gross stage 3 assets in non-banking finance companies (NBFC) are loans which have been overdue for more than 90 days. As NBFC follow Indian Accounting Standards (Ind AS), they have to classify bad loans in three categories or stages.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the related assets or liabilities. Level 3 assets and liabilities include those whose value is determined using market standard valuation techniques described above.

'3 - Low to medium risk' investors: likely to accept some risk in return for the potential of higher investment gains over the long-term. Try to avoid large fluctuations in the investment value, but accept there will be some fluctuation, particularly over the short-term.

Rule 1: Never Lose Money

But, in fact, events can transpire that can cause an investor to forget this rule.

What is Warren Buffett's investment strategy?

Warren Buffett is perhaps the best example of the power of long-term compounding. Buffett uses compound interest, dividend reinvestment, and the power of constantly reinvesting the operating cash flow generated by Berkshire's businesses to his advantage.

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

- Money market funds.

- Mutual funds.

- Index Funds.

- Exchange-traded funds.

- Stocks.

Buy and Hold

Buying and holding investments is perhaps the simplest strategy for achieving growth. If you have a long time to invest before needing your money, it can also be one of the most effective.

Common stocks can provide both dividends and capital gains. Fixed-income securities can also provide capital gains in addition to interest or dividend income, and partnerships can provide any or all of the above forms of income on a tax-advantaged basis.

The best investment strategy is the one that helps you achieve your financial goals. A review of some of the top investors will show that for every investor, the best strategy will be different. For example, if you're looking for the quickest profit with the highest risk, momentum trading is for you.

References

- https://www.investopedia.com/articles/financial-theory/11/corporate-project-valuation-methods.asp

- https://investmentinsight0.medium.com/investment-vs-capital-understanding-the-differences-and-importance-9d0b37975941

- https://www.thebalancemoney.com/capital-investment-2948114

- https://www.salary.com/research/salary/benchmark/investment-analyst-salary

- https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/how-to-evaluate-capital-investment-questions-to-ask

- https://www.investopedia.com/terms/v/venturecapitalist.asp

- https://www.financestrategists.com/wealth-management/fundamental-vs-technical-analysis/the-methods-of-investment-analysis/

- https://www.bogleheads.org/wiki/Three-fund_portfolio

- https://www.jmfinn.com/our-thinking/expense-vs-investment/

- https://www.investopedia.com/terms/l/level3_assets.asp

- https://www.linkedin.com/advice/0/what-does-investment-analyst-do-skills-business-analysis-pckae

- https://www.investopedia.com/terms/i/investment-analysis.asp

- https://www.physiciansidegigs.com/three-fund-portfolio

- https://www.bryantstratton.edu/blog/2023/november/love-shark-tank-lets-dive-into-entrepreneurship

- https://www.hdfclife.com/insurance-knowledge-centre/investment-for-future-planning/types-of-investments

- https://www.schwab.com/learn/story/investing-styles

- https://homework.study.com/explanation/why-are-firms-not-using-100-percent-debt-financing.html

- https://www.linkedin.com/advice/0/what-most-effective-ways-evaluate-capital

- https://www.primerica.com/public/rule-of-72.html

- https://www.toppr.com/ask/question/which-of-the-following-is-not-a-capital-budgeting-decision/

- https://www.studysmarter.co.uk/explanations/business-studies/corporate-finance/capital-investments/

- https://www.wallstreetmojo.com/capital-budgeting-methods/

- https://cleartax.in/glossary/investment

- https://www.fool.com/investing/how-to-invest/famous-investors/warren-buffett-investments/

- https://www.investopedia.com/ask/answers/050515/it-better-use-fundamental-analysis-technical-analysis-or-quantitative-analysis-evaluate-longterm.asp

- https://www.investopedia.com/ask/answers/012815/what-assets-are-most-risky-and-what-assets-are-safest.asp

- https://cleartax.in/glossary/capital-investment

- https://www.archi-qs.com.au/capital-investment-value-employment-estimates/

- https://imarticus.org/blog/top-investment-appraisal-methods-for-financial-management/

- https://www.investopedia.com/terms/i/investing.asp

- https://happay.com/blog/capital-investment/

- https://www.investopedia.com/articles/professionals/111015/investment-analyst-career-path-and-qualifications.asp

- https://www.careerprinciples.com/resources/investment-banking-hours

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://www.investopedia.com/articles/financial-theory/09/how-investments-make-money-income.asp

- https://www.investopedia.com/terms/c/capitalstructure.asp

- https://www.investopedia.com/terms/i/investment.asp

- https://www.allbusinessschools.com/specialties/how-to-become-a-financial-analyst/

- https://careerbootcamps.stonybrook.edu/blog/data-analytics/highest-paying-data-analyst-jobs/

- https://www.investopedia.com/financial-edge/0210/rules-that-warren-buffett-lives-by.aspx

- https://www.investopedia.com/ask/answers/05/npv-irr.asp

- https://www.linkedin.com/company/capital-investment-companies

- https://smartasset.com/financial-advisor/investment-analysis

- https://www.planningretirements.com/blog/7-steps-financial-planning-process/

- https://www.linkedin.com/pulse/capital-investment-how-works-kison-patel

- https://mailchimp.com/marketing-glossary/roi/

- https://homework.study.com/explanation/which-of-the-four-methods-of-evaluating-capital-projects-would-you-prefer-to-use-and-why-how-would-the-type-of-capital-investment-decision-you-were-making-affect-your-choice-of-method.html

- https://www.paulmerriman.com/4-fund-combo

- https://www.investopedia.com/articles/investing/081315/9-top-assets-protection-against-inflation.asp

- https://bdhsterling.com/explained-the-4-main-asset-classes-that-could-form-part-of-your-portfolio/

- https://quizlet.com/283489981/unit-7-concepts-flash-cards/

- https://www.finra.org/investors/investing/investing-basics/investment-goals

- https://www.tataaia.com/blogs/financial-planning/5-important-steps-of-the-investment-process.html

- https://valuationacademy.com/principles-of-capital-budgeting/

- https://byjus.com/commerce/investment/

- https://www.bbvaspark.com/contenido/en/news/what-capital-investment-how/

- https://techguide.org/careers/investment-analyst/

- https://www.investopedia.com/terms/c/capitalbudgeting.asp

- https://www.investopedia.com/terms/c/capital.asp

- https://www.investopedia.com/articles/financialcareers/06/financialanalyst.asp

- https://coresignal.com/blog/investment-analysis/

- https://www.indeed.com/career-advice/interviewing/interview-questions-for-financial-analyst

- https://pureprimesol.com/evaluate-capital-investment/

- https://www.inc.com/encyclopedia/venture-capital.html

- https://www.moneycontrol.com/news/mcminis/what-are-stage-3-assets-in-nbfc-10110951.html

- https://www.nirmalbang.com/knowledge-center/growth-investing-strategy.html

- https://mergersandinquisitions.com/investment-banking-analyst-job/

- https://study.com/learn/lesson/capital-budgeting-decisions-examples-techniques-analysis.html

- https://www.bajajfinserv.in/investments/investment-process

- https://www.investopedia.com/articles/basics/13/portfolio-growth-strategies.asp

- https://www.zelleducation.com/blog/what-is-capital-budgeting-its-process/

- https://www.investopedia.com/ask/answers/041515/which-asset-classes-are-most-risky.asp

- https://www.investopedia.com/terms/l/longterminvestments.asp

- https://www.investopedia.com/terms/i/investmentstrategy.asp

- https://www.extension.iastate.edu/agdm/wholefarm/html/c5-240.html

- https://www.nasdaq.com/articles/capital-investment-definition-types-decisions-and-budgeting

- https://www.mdpi.com/2079-8954/11/3/146

- https://homework.study.com/explanation/which-method-of-evaluating-capital-investment-proposals-uses-the-concept-of-present-value-to-compute-a-rate-of-return-a-average-rate-of-return-b-accounting-rate-of-return-c-cash-payback-period.html

- https://happay.com/blog/capital-budgeting/

- https://www.wallstreetmojo.com/3-fund-portfolio/

- https://www.quora.com/Is-investment-an-asset-or-owner-s-equity

- https://business.linkedin.com/talent-solutions/resources/how-to-hire-guides/capital-market-analyst

- https://www.finra.org/sites/default/files/NoticeDocument/p012413.pdf

- https://www.chegg.com/homework-help/questions-and-answers/two-commonly-used-methods-capital-budgeting-analysis--internal-rate-return-net-present-val-q30432474

- https://www.nerdwallet.com/article/investing/what-is-passive-income-and-how-do-i-earn-it

- https://www.quora.com/What-is-a-capital-investment-cycle

- https://www.springboard.com/blog/data-analytics/data-analyst-salary/

- https://www.bankrate.com/investing/low-risk-investments/

- https://www.intellis.io/blog/what-is-the-difference-between-capital-investment-and-capital-planning

- https://www.chegg.com/homework-help/questions-and-answers/another-term-capital-investment-analysis-o-investment-capital-o-investment-rationing-capit-q124753270

- https://www.canarahsbclife.com/blog/financial-planning/what-is-investment

- https://www.studystack.com/flashcard-3577095

- https://corporatefinanceinstitute.com/resources/fpa/capital-budgeting-best-practices/

- https://www.studysmarter.co.uk/explanations/business-studies/financial-performance/average-rate-of-return/

- https://support.fathomhq.com/en/articles/2328072-how-is-total-invested-capital-calculated

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/capital-investments

- https://www.bankrate.com/investing/investment-strategies-for-beginners/

- https://www.nerdwallet.com/article/investing/most-expensive-stocks

- https://www.fylehq.com/blog/capital-budgeting

- https://www.studysmarter.co.uk/explanations/business-studies/financial-performance/investments/

- https://www.investopedia.com/financial-edge/0213/a-day-in-the-life-of-a-financial-analyst.aspx

- https://www.ambitionbox.com/profile/investment-analyst-salary

- https://www.ziprecruiter.com/career/Work-From-Home-Financial-Analyst/What-Is-How-to-Become

- https://www.glassdoor.co.in/Career/investment-analyst-career_KO0,18.htm

- https://www.investopedia.com/investing/investing-strategies/

- https://www.investopedia.com/terms/c/capital-investment-analysis.asp

- https://www.tataaia.com/blogs/financial-planning/what-are-the-objectives-of-investment.html

- https://www.bajajfinserv.in/investments/complete-guide-investing

- https://www.zurich.ie/funds/risk-ratings/

- https://brainly.com/question/11161801

- https://ucincinnatipress.pressbooks.pub/principlesaccounting/chapter/capital-budgeting-decision-making/

- https://www.chegg.com/homework-help/questions-and-answers/capital-budgeting-process-requires-four-steps-complete-1-finding-new-investment-opportunit-q38308323

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4406204

- https://nationalcareers.service.gov.uk/job-profiles/investment-analyst

- https://www.cafonline.org/charities/investments/understanding-strategies-and-styles-of-investing

- https://www.investopedia.com/terms/c/capital-investment.asp

- https://www.schwab.com/taxes/investment-related-taxes

- https://www.taxmann.com/post/blog/overview-of-capital-budgeting-techniques-decisions-valuation-methods

- https://www.toptal.com/finance/budgeting/capital-budgeting-process

- https://www.unbiased.com/discover/investing/safest-investments

- https://www.investopedia.com/ask/answers/032415/which-investments-have-highest-historical-returns.asp

- https://www.matrixnac.com/what-is-a-capital-project/

- https://quizlet.com/explanations/questions/which-methods-of-evaluating-a-capital-investment-project-ignore-the-time-value-of-money-a-net-present-value-and-accounting-rate-of-return-b--ae612fc4-8fdd1671-5844-41cb-a3e1-ca6449e6d3a2

- https://www.sec.gov/Archives/edgar/data/898174/000089817420000005/R17.htm

- https://www.schwab.com/learn/story/6-things-to-know-about-how-mutual-funds-work

- https://www.cfainstitute.org/en/programs/cfa/charterholder-careers/roles/financial-analyst

- https://smartasset.com/investing/types-of-investment

- https://study.com/learn/lesson/return-on-investment-calculation-examples-analysis.html

- https://www.investopedia.com/terms/c/capitalexpenditure.asp

- https://www.ifec.org.hk/web/en/other-resources/hot-topics/5-investment-concepts.page

- https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/investments